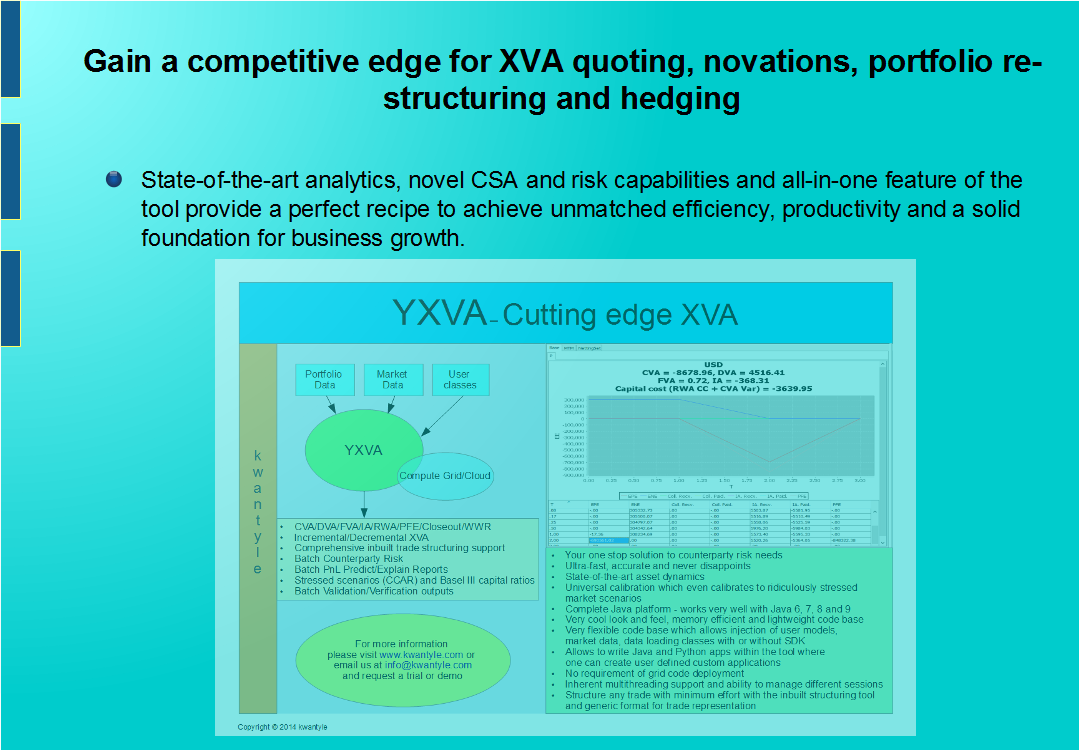

Check out YXVA, our state-of-the-art XVA platform which can solve your almost any problem or need. We can provide you the business consulting needed for getting the ideas and tools integrated for your firm. Request a quote today for your consulting needs.

A robust platform and set of tools for hedging Counterparty Credit Risk

- A one stop shop for computing CVA/FVA/RWA/IA, in short XVA in general

- In addition Closeout, Generic Wrong-Way-Risk (GWWR) and Specific-Wrong-Way-Risk (SWWR) frameworks faciliate accurate quantification of GAP risk

- A very flexible framework for customising XVA computation as much as possible

- Allows you to run practically any what-if scenarios and thus helps you to do the right trade and stay away from bad ones

- Get your exposure and risk almost instantaneously – a must have feature

- A tool with which you can do lots of cool XVA things with quite an ease

- Allows you to structure any possible trade with minimum effort

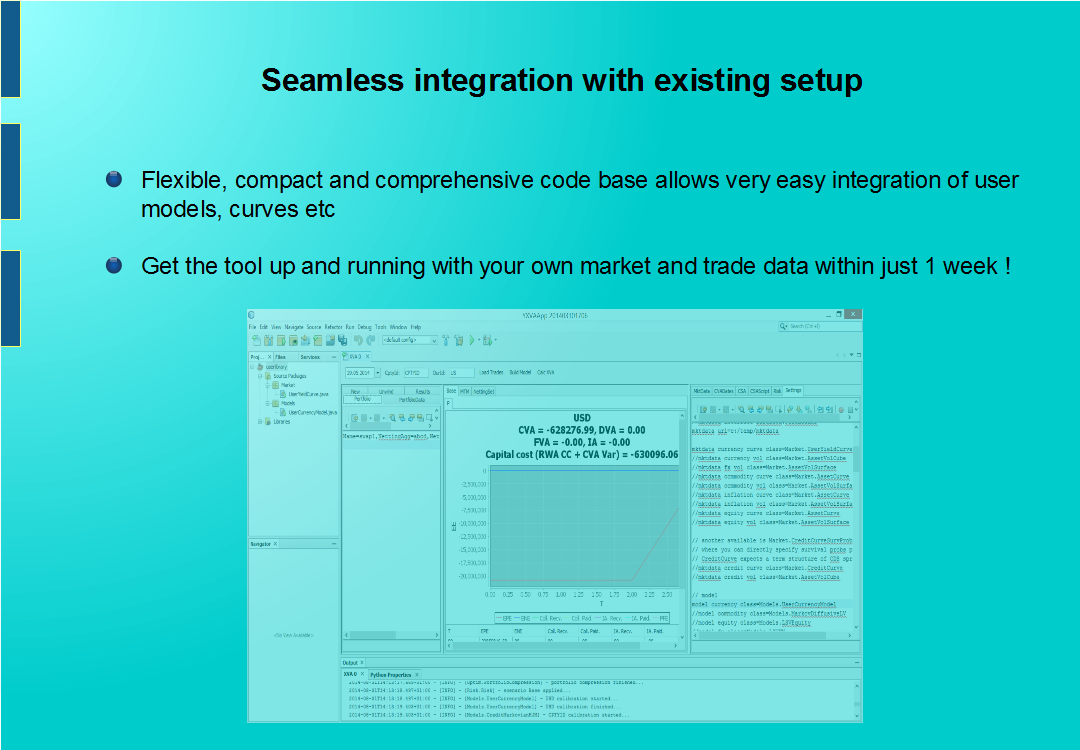

- Allows you to integrate and use your own market data/models/calculations within the tool/framework - very convenient feature

- Helps you to get rid of bulky and sometimes buggy spreadsheets and make you vendor and platform independent and free of any hassles

- Inherent multithreading and distribution support

- No hassles of code deployment